This printed article is located at https://kimsengheng.listedcompany.com/financials.html

Financials

Half Year Financial Statement And Dividend Announcement 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

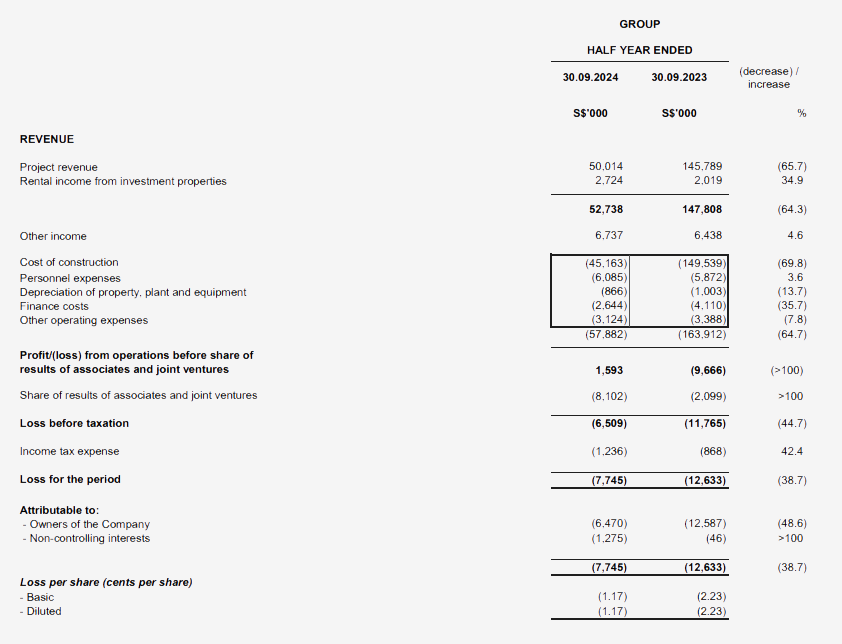

Condensed interim consolidated income statement

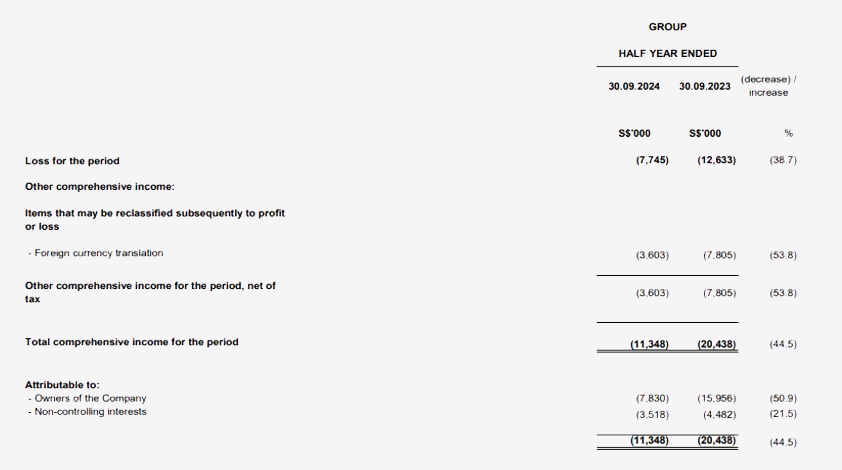

Condensed interim consolidated statement of comprehensive income

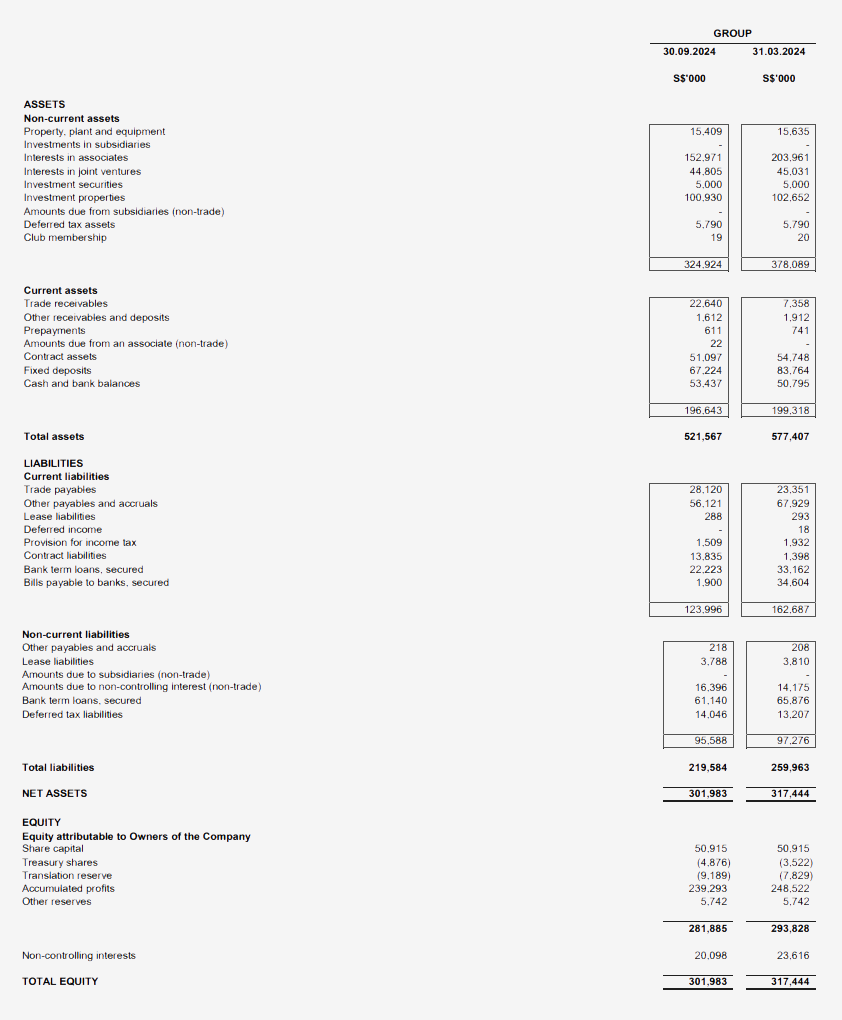

Condensed interim balance sheets

Review of Performance

1HFY2025 vs 1HFY2024

Revenue

The Group had a total revenue of S$52.7 million for 1HFY2025, a decrease of S$95.1 million compared to S$147.8 million in the corresponding 1HFY2024. The decrease was mainly due to the decrease in revenue from construction business by S$95.8 million from S$145.8 million in 1HFY2024 to S$50.0 million in 1HFY2025. The decrease in construction revenue was mainly due to completion of various projects awarded just before or during COVID-19 pandemic in 1HFY2024, while projects awarded and commenced post-pandemic period were still in early stage of construction in 1HFY2025.

Other income

The increase in other income of S$0.3 million from S$6.4 million in 1HFY2024 to S$6.7 million in 1HFY2025 was mainly due to gain from disposal of plant and equipment.

Other operating expenses

Cost of construction decreased by S$104.3 million from S$149.5 million in 1HFY2024 to S$45.2 million in 1HFY2025 in line with the lower construction revenue. Construction business has turned around with positive gross profit margin in 1HFY2025.

Personnel expenses increased by S$0.2 million in 1HFY2025 as compared to 1HFY2024 mainly due to under accruals of staff bonuses for prior financial year.

Finance costs decreased by S$1.5 million from S$4.1 million in 1HFY2024 to S$2.6 million in 1HFY2025 mainly due to lower gearing.

Other operating expenses decreased by S$0.3 million from S$3.4 million in 1HFY2024 to S$3.1 million in 1HFY2025 mainly due to decrease in foreign exchange losses.

Share of results of associates and joint ventures incurred a loss of S$8.1 million mainly due to losses incurred by the property development projects of associates and joint ventures, which primarily stemmed from pre-launch expenses, finance costs, sales and marketing expenses, and other operating costs that were recognised as expense while revenue can only be recognised when the units are sold and control over the property has been transferred to customer, in accordance with the adopted accounting standards.

Tax expense increased in 1HFY2025 as compared to 1HFY2024 mainly due to additional deferred tax provided for business in PRC.

Overall, the Group recorded a loss attributable to owners of the Company of S$6.5 million in 1HFY2025 as compared to a loss of S$12.6 million in 1HFY2024 excluding non-controlling interests.

Group Statement of Financial Position Review

Non-current assets as at 1HFY2025 decreased by S$53.2 million or 14.0% to S$324.9 million as compared to S$378.1 million as at FY2024 mainly due to the decrease in shareholder's loans and share of losses in associates and joint ventures.

The net current assets (current assets less current liabilities) of the Group was S$72.6 million as at 1HFY2025 as compared to S$36.6 million as at FY2024.

Fixed deposits, cash and bank balances has decreased by S$13.9 million from S$134.6 million in FY2024 to S$120.7 million in 1HFY2025 mainly due to repayment of in net banks borrowings, offset by repayment received from joint ventures and associates for shareholder's loan.

Gearing ratio (total loans and borrowings to equity) of the Group has improved significantly to 0.28x as at 1HFY2025 from 0.42x as at FY2024 with decrease in total loans and borrowings by S$48.3 million from S$133.6 million as at FY2024 to S$85.3 million as at 1HFY2025.

Commentary On Current Year Prospects

According to the Monetary Authority of Singapore (“MAS”)1,the global economy has remained broadly resilient underpinned by further declines in interest rates as inflation moderates worldwide. In Singapore, core inflation is expected to average around the mid-point of the forecast range of 1.5% to 2.5% in 2025. Imported costs are forecast to be broadly stable next year, reflecting an anticipated unwinding of oil production cuts. An intensification of geopolitical tensions and commodity price shocks could add to imported costs. However, a significant downturn in the global economy would induce an easing in cost and price pressures, causing domestic inflation to come in materially lower than expected. As Singapore’s interest rates are largely influenced by global rates, the reduction in interest rates by the Federal Reserve will likely lead Singapore into a lower interest rate environment, thereby reducing financing cost.

Based on advanced estimates from the Ministry of Trade and Industry (“MTI”)2,Singapore’s economy expanded by 2.1% on a quarter-on-quarter seasonally-adjusted basis in the third quarter, outperforming the average 0.4% growth in the first half of the year. This growth is expected to continue through 2024, supported by the upswing in the electronics and trade cycles and the easing in global financial conditions.

According to MTI, the construction sector grew by 3.1% year-on-year in the third quarter, easing from the 4.8% growth in the preceding quarter, attributed to an increase in public-sector construction output. On a quarter-on-quarter seasonally-adjusted basis, construction growth was flat sequentially, slowing from the 3.4% growth in the second quarter.

The overall private housing prices as reported by the Urban Redevelopment Authority ("URA”) declined by 0.7%, marking the first decline since the second quarter of 2023. Price momentum eased across all market segments3. For the first three quarters of 2024, the overall private housing prices increased by 1.6%, a significant moderation from the 3.9% gain over the same period in 2023. While macroeconomic conditions remain sound, the economic outlook is subject to uncertainties, and market sentiments remain sensitive to geopolitical developments and global interest rate changes.

Despite uncertainties in macroeconomic factors, the investment properties and hotels held by the Group in Singapore and overseas have maintained good occupancy rates and rental rates.

The Group’s construction order book remains healthy at more than S$331.0 million as at 31 October 2024. The Group is also currently working on several tenders to replenish the order book to a higher amount.

The Group is currently participating in four joint ventures for proposed residential and mixed redevelopment in Singapore. Three of these projects, The Arcady at Boon Keng, One Sophia/The Collective at One Sophia, and Sora at Yuan Ching Road in District 22 have achieved satisfactory sales with expected positive margin since launch in the year 2024. Bagnall Haus at 811 Upper East Coast, are scheduled for launch by the first quarter in the year 2025. Construction for The Arcady at Boon Kheng commenced during 1HFY2025 while the other three projects are targeted to commence by end FY2025. Based on options signed for the above-mentioned launched projects as at end October 2024, the Group’s equity shares of unrecognised attributable revenue on sold units was approximately S$93.4 million and will be recognised based on percentage of completion in accordance with construction progress.

In China, the Chinese government’s stimulus efforts have revived buyer interest and boosted confidence, leading to an increase in residential property sales in October this year. The Group has investments in two projects with on-going residential development in Gaobeidian, Singapore Sino Health City - Zhong Xin Yue Lang (中新健康城 - 中新悦朗) ("ZXYL") and Zhong Xin Yue Shang (中新悦上) ("ZXYS") with equity stakes of 22.5% and 33.75% respectively.

[1] MAS Monetary Policy Statement, Monetary Authority of Singapore – 14 October 2024.

[2] Ministry of Trade and Industry Singapore, Singapore’s GDP Grew by 4.1 Per Cent in the Third Quarter of 2024 – October 2024.

[3] Overall private housing prices declined in 3rd Quarter 2024, Urban Redevelopment Authority – 25 October 2024.