We are committed to providing timely, high quality information to investor on the internet.

Financials

Financials

Full Year Financial Statement And Dividend Announcement 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

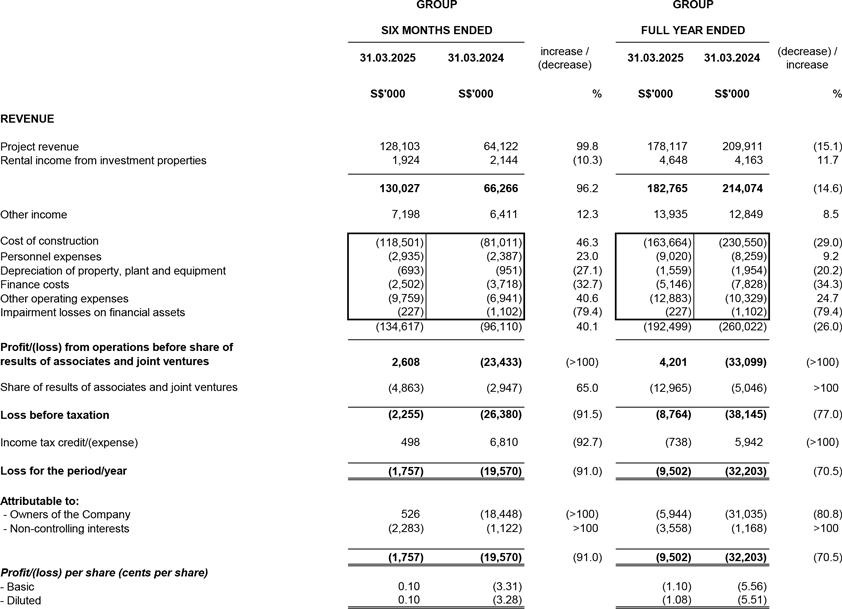

Condensed interim consolidated income statement

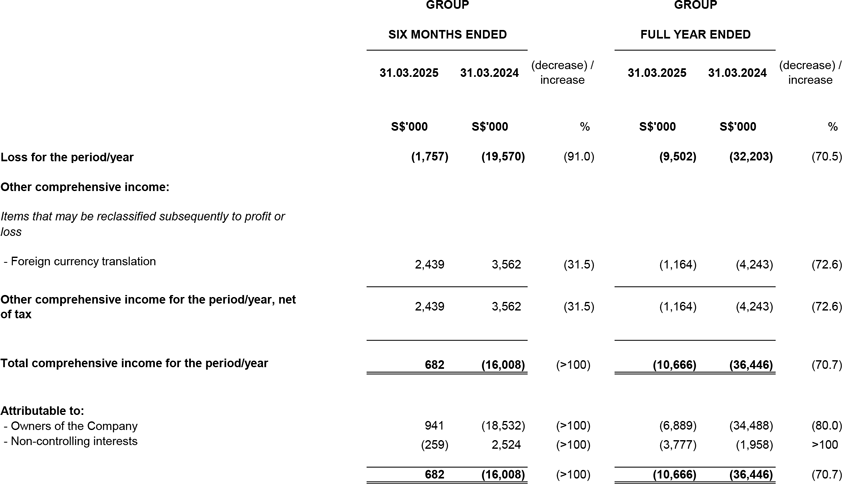

Condensed interim consolidated statement of comprehensive income

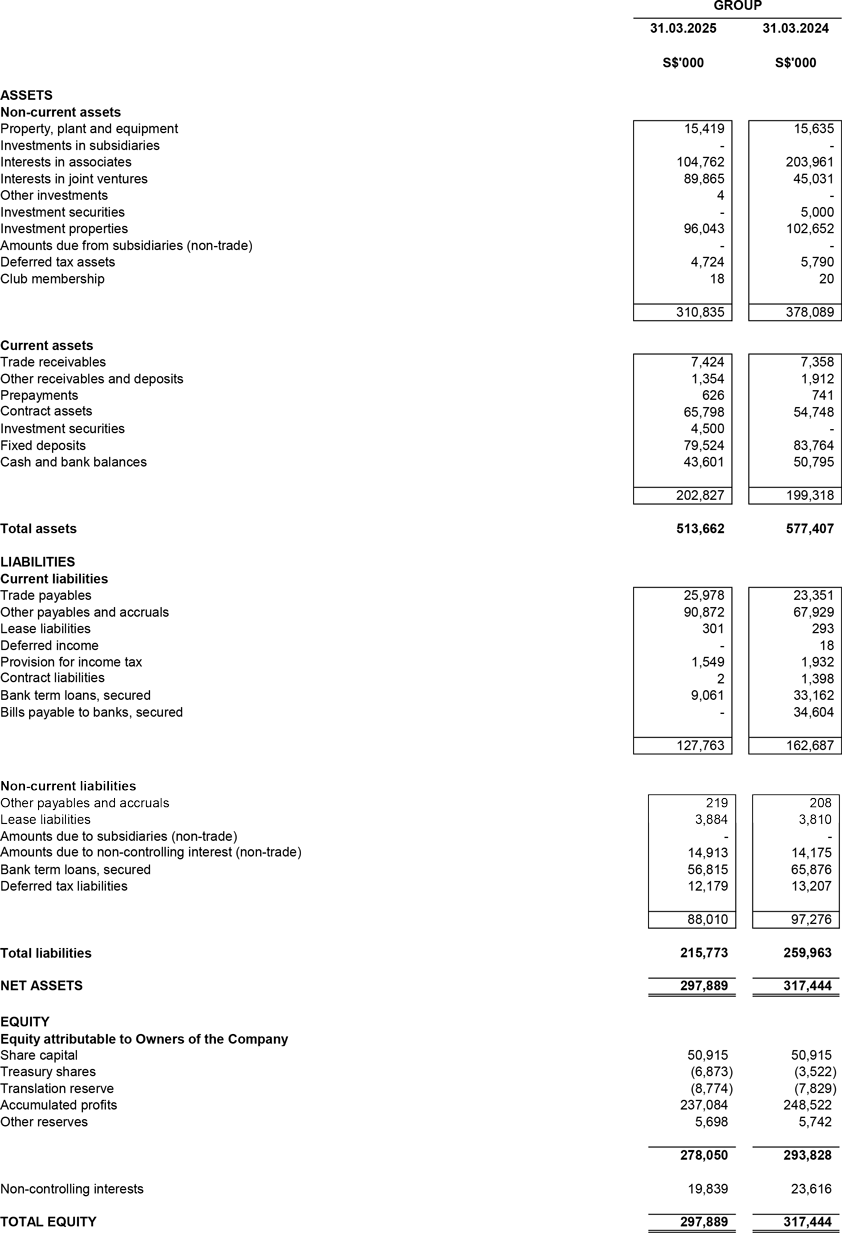

Condensed interim balance sheets

Review of Performance

2HFY2025 vs 2HFY2024

Revenue

The Group had a total revenue of S$130.0 million for 2HFY2025, an increase of S$63.7 million compared to S$66.3 million in the corresponding 2HFY2024. The increase was mainly due to the increase in revenue from construction business by S$64.0 million from S$64.1 million in 2HFY2024 to S$128.1 million in 2HFY2025, reflecting good progress in our construction business.

Other income

The increase in other income of S$0.8 million from S$6.4 million in 2HFY2024 to S$7.2 million in FY2025 was mainly due to the gain on fair value adjustments of investment properties in Singapore and gain on disposal of plant and equipment, offset by the decrease in interest income.

Other operating expenses

Cost of construction increased by S$37.5 million from S$81.0 million in 2HFY2024 to S$118.5 million in 2HFY2025 in line with the increased construction revenue. The construction business has turned around with positive gross profit margin in 2HFY2025.

Personnel expenses increased by S$0.5 million in 2HFY2025 as compared to 2HFY2024 mainly due to provision for staff and workers bonuses.

Depreciation of property, plant and equipment decreased by S$0.3 million in 2HFY2025 as compared to 2HFY2024 in line with the decrease in property, plant and equipment.

Finance costs decreased by S$1.2 million from S$3.7 million in 2HFY2024 to S$2.5 million in 2HFY2025 mainly due to lower gearing.

Other operating expenses increased by S$2.9 million from S$6.9 million in 2HFY2024 to S$9.8 million in 2HFY2025 mainly due to the increase in loss on fair value adjustments of investment property in the PRC of S$2.6 million from S$4.5 million in 2HFY2024 to S$7.1 million in 2HFY2025.

Share of results of associates and joint ventures incurred a loss of S$4.9 million mainly due to losses incurred by the property development projects of associates and joint ventures in Singapore, which primarily stemmed from pre-launch expenses, finance costs, sales and marketing expenses, and other operating costs that need to be recognised before revenue from sold units were limited by the percentage of completion on construction for these projects which were either have not commenced construction or still in preliminary stage at the end of 2HFY2025 in accordance with the adopted accounting standards.

Overall, the Group recorded a net profit attributable to owners of the Company of S$0.5 million in 2HFY2025 as compared to a loss of S$18.4 million in 2HFY2024 excluding non-controlling interests.

FY2025 vs FY2024

Revenue

The Group had a total revenue of S$182.8 million for FY2025, a decrease of S$31.3 million compared to S$214.1 million in FY2024. The decrease was primarily due to lower revenue from the Group's construction business, which registered a S$31.8 million decline to S$178.1 million in FY2025. This was mainly due to the completion of various projects awarded just before or during the Covid-19 pandemic, while projects awarded and commenced post-pandemic were still in the early stages of construction.

Other income

Other income increased by S$1.1 million from S$12.8 million in FY2024 to S$13.9 million in FY2025 was mainly due to the gain on fair value adjustments of investment properties in Singapore and gain on disposal of plant and equipment.

Other operating expenses

Cost of construction decreased by S$66.9 million from S$230.6 million in FY2024 to S$163.7 million in FY2025 mainly due to a reduction in construction works. The construction business has since turned around with a positive gross profit margin in FY2025.

Finance costs decreased by S$2.7 million from S$7.8 million in FY2024 to S$5.1 million in FY2025 mainly due to lower gearing.

Other operating expenses increased by S$2.6 million from S$10.3 million in FY2024 to S$12.9 million in FY2025 mainly due to the increase in loss on fair value adjustments of investment properties in the PRC of S$2.6 million from S$4.5 million in FY2024 to S$7.1 million in FY2025.

Share of results of associates and joint ventures incurred a loss of S$13.0 million. This was mainly due to losses incurred by the property development projects of associates and joint ventures, which primarily stemmed from pre-launch expenses, finance costs, sales and marketing expenses, and other operating costs that need to be recognised before revenue from sold units were limited by the percentage of completion on construction for these projects which were either have not commenced or still in a preliminary stage at the end of FY2025.

Based on the above factors, the Group recorded a loss attributable to owners of the Company of S$5.9 million in FY2025 after excluding non-controlling interests.

Group Statement of Financial Position Review

Non-current assets as at FY2025 decreased by S$67.3 million or 17.8% to S$310.8 million as compared to S$378.1 million as at FY2024 mainly due to the decrease in shareholder's loans, share of losses in associates and joint ventures and the decrease in investment properties due to valuation loss in the PRC.

The net current assets (current assets less current liabilities) of the Group was S$75.1 million as at FY2025 as compared to S$36.6 million as at FY2024.

Fixed deposits, cash and bank balances has decreased by S$11.5 million from S$134.6 million in FY2024 to S$123.1 million in FY2025 mainly from net cash flows used in financing activities.

Total gearing ratio (debt to equity) of the Group was low and has improved to 0.22 as at FY2025 from 0.42 as at FY2024.

Commentary On Current Year Prospects

Based on advance estimates by the Ministry of Trade and Industry ("MTI"), the Singapore economy grew by 3.8% year-on- year in the first quarter of 2025, slower than the 5.0% growth in the previous quarter. On a quarter-on-quarter seasonally- adjusted basis, the economy contracted by 0.8%, a reversal from the 0.5% expansion in the fourth quarter of 2024. For 2025 as a whole, MTI downgraded Singapore's growth forecast to "0.0 to 2.0%" from "1.0 to 3.0%" on concerns that the sweeping tariffs introduced by the US, and the ongoing US-China trade war could weigh significantly on global trade and global economic growth. MTI assesses that the external demand outlook for Singapore for the rest of the year has weakened significantly(1).

Construction

According to the MTI, the construction sector grew by 4.6% year-on-year in the first quarter, extending the 4.4% growth in the previous quarter, supported by an increase in both public and private sector construction output. On a quarter-on-quarter seasonally-adjusted basis, the sector contracted by 2.3%, a pullback from the 0.3% expansion in the preceding quarter. The Building and Construction Authority projects that some $47 billion to $53 billion in construction contracts are expected to be awarded in 2025, as construction demand grows this year due to the launch of major public infrastructure projects and development of public and private housing(2).

As at 31 March 2025, the Group's construction order book remains healthy at over S$230.0 million and is expected to contribute positively to the Group's performance in the financial year ending 31 March 2026. The Group is also working on several tenders to bring the order book to a higher amount.

Property Development

According to the flash estimate released by the Urban Redevelopment Authority for private residential properties, the price index increased by 0.6% in the first quarter of 2025, moderating from the 2.3% increase in the previous quarter, while total sale transaction volume fell by about 15%, exhibiting signs of moderation following several years of robust growth(3).

The Group is currently participating in four joint ventures for proposed residential and mixed redevelopment in Singapore. These developments, namely The Arcady at Boon Keng, One Sophia/The Collective at One Sophia, Sora at Yuan Ching Road in District 22, and Bagnall Haus at 811 Upper East Coas have recorded satisfactory sales with positive margin expected since their respective launches. Construction is underway for all four developments. Based on the options signed as at 31 March 2025, the Group's equity share of unrecognised attributable revenue from sold units amount to more than S$162.0 million, which will be recognised progressively based on the percentage of completion method in accordance with construction progress.

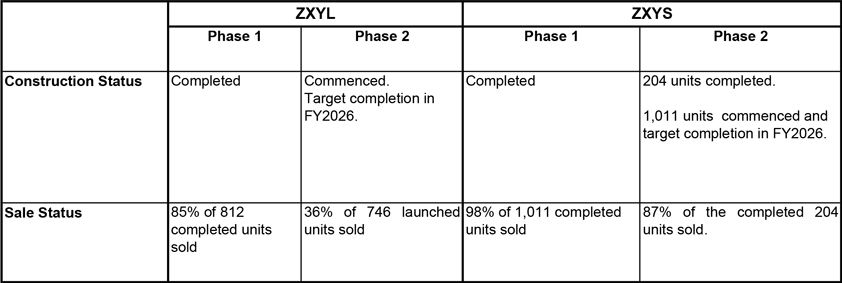

The property market in the PRC remains challenging and the Group will continue to monitor the situation. The Group has investments in two projects with on-going residential developments in Gaobeidian, namely Singapore Sino Health City–ZXYL (中新健康城 - 中新悦朗) ("SSHC-ZXYL") and Zhong Xin Yue Shang (中新悦上) ("ZXYS") with equity stakes of 22.5% and 33.75% respectively.

The construction and sale status of the projects as at end March 2025 are as follows:

Property Investment

Hotel performance in countries such as the United Kingdom and Japan has continued to improve, although uncertainties loom as global macroeconomic factors could potentially impact hotel operations and investment in the near future. Despite these uncertainties, the Group's investment properties in Singapore and overseas have maintained satisfactory occupancy rates and rental rates.

Barring any unforeseen circumstances, the Group remains cautiously optimistic amid ongoing challenges and uncertainties, including rising interest rates, foreign exchange exposure, and the impact of possible higher construction costs on the performance of its construction and development projects.

(1)"Singapore's GDP grew by 3.8 per cent in the first quarter of 2025. MTI downgrades Singapore's GDP growth forecast for 2025 to "0.0 to 2.0 per cent", the

Ministry of Trade and Industry, 14 April 2025.

(2)"Construction Demand To Remain Strong For 2025", Building and Construction Authority, 23 January 2025.

(3)"Moderation of prices and sales momentum in private residential market", Urban Redevelopment Authority, 1 April 2025.